- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How To Search Alabama Business Entities

- How To Search Alabama Business Entities

- How To Find the Owner of a Business Entity in Alabama?

- Why Conduct a Alabama Entity Search?

- Who Holds Data for Alabama Business Entity Search?

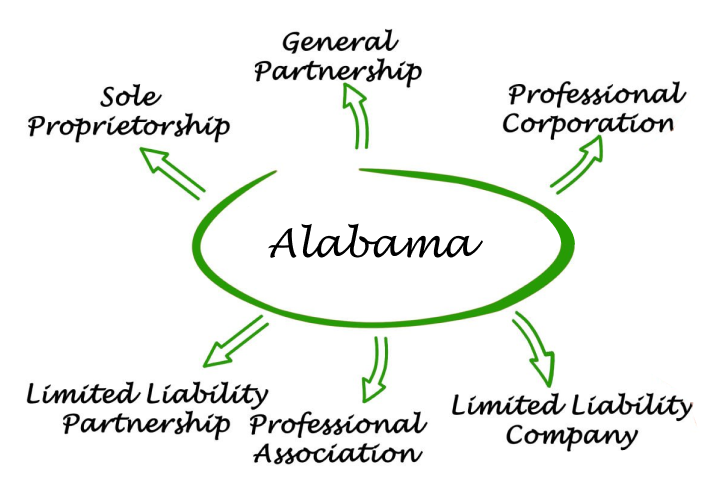

- What Entities Can You Register in Alabama?

- How Do I Check If a Business Entity Name is Taken in Alabama?

- How Do I Set Up a Business Entity in Alabama?

- How Much Does It Cost To Start a Business In Alabama?

- Additional Information Available on the Alabama Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Alabama

The Alabama Secretary of State provides the most up-to-date resource for business entity information in the state. Every year, about 238,000 to 260,000 new business entities are established in Alabama. These business entities range from limited liability companies, professional corporations, limited liability partnerships, and sole proprietorships to limited partnerships and non-profit corporations.

Generally, access to business entity records helps confirm the legitimacy and legal existence of business entities. In addition, it promotes transparency, helping protect consumers and investors from fraudulent business entities.

Choose Your Search Criteria:

The platform offers different search options, including:

- Entity Name:

Search by entity name requires the full or partial name of the business entity

- Entity Number:

Accessing business entity records using the entity number requires the nine-digit identification number assigned to all businesses at registration

- Officer/Agent/Incorporator

Access to business entity records using this criteria requires the complete or partial name of the officer, registered agent, or individual who registered the entity

- Reservation/Registration by ID:

Use this search field to access business records using the reserved name registered with the Alabama Secretary of State before the business was duly registered.

Review Search Results

After choosing your preferred search criteria, enter the relevant information, such as the entity name or number, the incorporating agent, or the business reserved name. The result displays a list of entity names, the nine-digit entity ID, city, type of company, and business status matching the search criteria.

Further Assistance

If you require further assistance searching for business entity records, contact the Alabama Secretary of State’s office.

How To Find the Owner of a Business Entity in Alabama?

Record seekers may find the owner of a business entity using online public search engines. Generally, public search engines do not disclose detailed information such as the entity ID number, the business annual report, or the company’s ownership. Therefore, searchers may need to utilize governmental resources to access such information.

Generally, the Alabama Secretary of State Business Entity Records web page, provides detailed information, including the registered owner of a business entity. Typically, search results from the platform offer information on the owners of a business entity, including their organizer’s name and members of the company. Persons seeking information on business owners may utilize the steps outlined to obtain the desired information.

In addition, the following resources may provide access to information on the owners of business entities in Alabama:

Additional Resources for Business Ownership Info

- Local Chambers of Commerce

The Chambers of Commerce maintains directories of all businesses and their owners

- City Business License Offices

Most Alabama cities and counties require businesses to obtain a local business license. These records typically include the list of owners' names and persons responsible for the business.

- Better Business Bureau (BBB)

The BBB provides access to business listings in the United States, including Alabama. Visit BBB

- Other Public Records

Utility providers and county or city tax assessors maintain records of business entities. Municipalities require business owners to register with utility providers, and tax offices maintain records of property taxes linked to business properties and their owners.

Why Conduct an Alabama Entity Search?

It is essential to know who you are dealing with when engaging with a business, whether as a consumer, partner, or investor. Whether planning to collaborate with a new supplier, understanding your rivals, or verifying a company’s legitimacy, individuals may use business entity searches to build customers' trust or confirm a business’s legitimacy.

Before investing in any business, it is crucial to ensure that the company is operating legally. Therefore, investors utilize business entity searches to understand the business structure, identify key decision makers, review the company’s history, and study the business competitors, before making investment commitments.

Verifying a supplier's legitimacy and reliability is essential for protecting business financial and operational risks. Therefore, businesses can ensure that their suppliers are trustworthy and compliant by conducting an Alabama entity search.

Conducting an Alabama entity search helps protect businesses from financial risks. Entity searches help to confirm business legitimacy, identify verifiable contact information, detect signs of business instability, and prevent fraud in supplier or contractor relationships.

Who Holds Data for Alabama Business Entity Search?

What Entities Can You Register in Alabama?

In Alabama, you can register the following business entities:

Alabama permits the registration of two different types of corporations. They are:

- C Corporation:

Operates as a separate legal entity from its shareholders. It has its own legal identity and can enter contracts, sue, and be sued. The corporation is liable for its debts, obligations, and legal liabilities.

- S Corporation:

Businesses that choose to be taxed as a partnership. S Corporations do not pay federal corporate tax.

LLCs in Alabama are hybrid companies combining features of corporations and partnerships. They protect the assets of their members from business debt and liabilities. Taxes are passed through to the members’ personal income tax returns.

LPs consist of general and limited partners. General partners have unlimited liability and may be held responsible for business debts. Limited partners have liability restricted to their investment in the business.

LLPs are partnerships where all partners have limited liability. They are not personally responsible for business debts.

LLLPs are specialized entities where both general and limited partners receive liability protection. Partners' personal assets are protected from business debts. Profits and losses are reported on individual tax returns.

GPs are formed by two or more individuals who share ownership, contribute to the business, share profits, and are personally liable for business obligations.

Sole proprietorships are owned and managed by a single individual. The owner and business are legally the same entity, making the owner personally liable for all business obligations.

Nonprofit Corporations in Alabama operate for charitable, religious, educational, or scientific purposes benefiting the public. They are tax-exempt and do not pay federal income tax.

PAs are legal entities formed by licensed professionals such as doctors, lawyers, accountants, engineers, and architects to provide professional services.

How Do I Check If a Business Entity Name is Taken in Alabama?

How Do I Set Up a Business Entity in Alabama?

Types of Business Entities in Alabama

Setting up a business entity in Alabama requires identifying the type of business you want to start and determining the best legal structure that suits the business. In Alabama, they may be:

- Sole Proprietorship

Best for small-scale entities owned and operated by a single individual

- Partnerships

Ideal for businesses with multiple owners

- LLCs

Best suited for small and medium-scale businesses seeking liability protections and tax benefits

- Corporations

Ideal for entities planning to issue stock or attract investors

- Nonprofit

Formed for charitable, educational, or religious deeds rather than profit-making

- Foreign Entities

Entities formed outside Alabama but transact business within the state

Generally, setting up a business entity in Alabama requires intending business owners to take the following steps:

- Choose a business name and reserve the same by filing the Name Reservation with the Secretary of State.

- Designate a registered agent.

- File the certificate of formation documents with the Alabama Secretary of State.

- Obtain a business license or permit from the county probate judge in the locations where the business intends to operate.

- Obtain an Employer Identification Number (EIN) for the business from the Internal Revenue Service (IRS).

- Register for a tax account with the Alabama Department of Revenue for state tax obligations.

- Obtain the necessary insurance coverage for the business from the Alabama Department of Insurance.

How Much Does It Cost To Start a Business In Alabama?

Business Registration Fees in Alabama

The cost to register a business in Alabama varies depending on the type of business entity. Generally, the filing fees are as follows:

- Certificate of Formation for Domestic Entities

$200

- Certificate of Formation for Foreign Entities

$150

- General Partnerships

$100

- Business Name Reservation (Paper Form)

$25

- Business Name Reservation (Online)

$28

- Annual Renewal Fee for Professional Associations

$100

- Late Renewal Fee (after Nov 1 +30 days)

$150 total ($100 + $50 late fee)

All corporations are required to receive the name of their business entity before formally registering the business. Typically, it costs $25 for name reservations through paper form and $28 for name reservation applications made online. In addition, there is a $100 annual renewal fee for professional associations. Professional association filing renewals 30 days after November 1 of any year attract an additional $50, making the annual renewal fees $150.

Additional Information Available on the Alabama Secretary of State's Website

The Alabama Secretary of State's website generally offers the following services, including:

- Business Forms:

Contains all forms required to register various types of business entities

- Business Entities:

Information about the operations of the Business Entity Division

- Online Services:

Access to all online services provided by the Alabama Secretary of State

- Domestic Corporations:

Access to relevant forms to file a domestic corporation or domestic nonprofit entity

- Foreign Corporations:

Contains information on foreign corporations qualified to operate and how to register a foreign corporation in Alabama

- Homeowners’ Associations:

Information and documents required to file Homeowners’ Associations entities

- Homeowners’ Association Electronic Database:

Online access to business entity records on Homeowners' Associations registered in the state

- Homeowners’ Association FAQ:

Frequently asked questions on registering a Homeowners Association in Alabama

- LLCs:

Filing a domestic or foreign limited liability company, fees, forms, and procedures

- LLPs:

Registering a domestic or foreign limited liability partnership, including fees, filing procedures, and forms

FAQs About Business Entity Searches in Alabama

Here are some of the most frequently asked questions and answers regarding business entity searches in Alabama.

- Why would I need to search for a business entity in Alabama?

You may need to verify that the business is registered with the Alabama Secretary of State and legally authorized to operate in Alabama.

- What types of entities can I search for in Alabama?

You may search for nonprofits, professional associations, LLCs, LLPs, LPs, and GPs.

- Where can I perform a business entity search in Alabama?

You can perform an online search for Alabama business entities using the Business Entity and Name Search web tool.

- What information do I need to conduct an entity search in Alabama?

Conducting an entity search requires searchers to have the full or partial name of the business entity, entity number, registered agent name, or registration ID.

- How do I find the official name of an Alabama business?

Generally, you may find the official name of an Alabama business using the Business Entity and Name Search page.

- Can I search for foreign entities in Alabama?

Yes. Typically, you may use the online search tool to look for business entities registered outside Alabama but authorized to conduct business within the state.

- What information can I find in the Alabama entity search?

Entity search results generally display the entity name, entity ID, city of operations, business owners, types of business, and the status of the entity.

- How do I verify if an Alabama business is in good standing?

The Business Entity and Name Search online tool allows you to check the status of a business, whether the business is in existence, canceled, dissolved, merged, or revoked.

- Can I search for an entity in Alabama by its owner's name?

Yes. The Business Entity and Name Search permits searches using the business owner’s name.

- How often is the Alabama business entity database updated?

The Alabama Secretary of State’s database is updated regularly, usually within a few days of registering the business.

- Can I obtain copies of business filings in Alabama?

Yes, you may obtain copies of business filings in Alabama through the Business Entity Document Copies Division.

- How do I find out who the registered agent of an Alabama business is?

You can find out the name of the registered agent of an Alabama business by using the entity’s name to search the Business Entity and Name Search tool. Typically, the results display the names of registered agents.

- How can I search for Alabama businesses by their tax ID number?

The Alabama Secretary of the Commonwealth's online search tool generally allows you to search for businesses using their tax ID numbers.

- What should I do if I can’t find a business entity in the Alabama search?

Check to ensure you have the right business name. In addition, older corporations registered from 1949 to 2010 are unavailable via the Alabama Secretary of State website. You may visit the Alabama Archives to access such business entity records.

- How To Search Alabama Business Entities

- How To Find the Owner of a Business Entity in Alabama?

- Why Conduct a Alabama Entity Search?

- Who Holds Data for Alabama Business Entity Search?

- What Entities Can You Register in Alabama?

- How Do I Check If a Business Entity Name is Taken in Alabama?

- How Do I Set Up a Business Entity in Alabama?

- How Much Does It Cost To Start a Business In Alabama?

- Additional Information Available on the Alabama Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Alabama